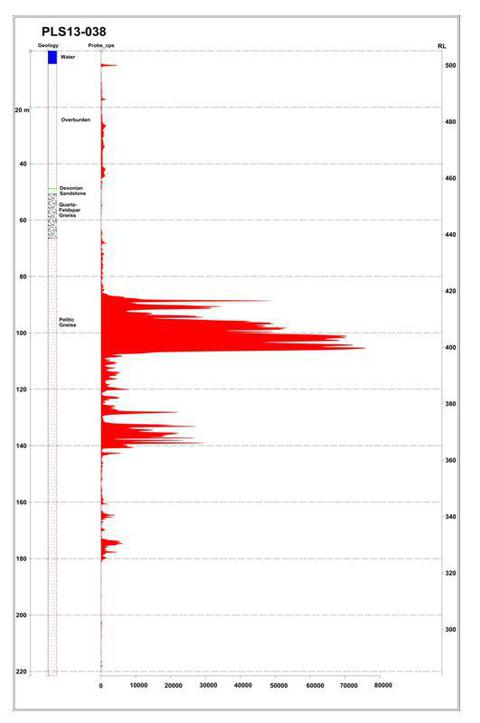

On February 19th, Alpha Minerals (ESOFD.PK and AMW on the TSX Venture) and Fission Energy (FSSIF.PK and FIS on the TSX Venture)announced a "game changing" drill result from hole PLS13-038 on their Patterson Lake project. 57.5 meters of strong mineralization was drilled starting at 87 meters depth, followed by 15m of additional intermittent mineralization starting at about 170m depth. This appears to be the best hole drilled at Patterson Lake so far, with descriptions of the mineralization being exactly what investors should want to see. Most importantly, this hole was drilled 385 meters east of the "discovery zone" where 37 meters of mineralization was previously reported. Assays are pending, but gamma probe measurements and core descriptions indicate high-grade uranium over significant widths (it should be noted that gamma probe readings are indicative of grade, but not predictive in an absolute sense). Patterson Lake maps and additional details can be found in the Alpha Minerals corporate presentation linked here.

Figure 1: Drill hole graphic showing consistent and highly radioactive mineralized intervals:

The uranium mineralization is being found along a geophysical conductor that has kilometers of strike length and the mineralization found to date remains open to expansion in all directions. The rock types and descriptions used in the press releases are textbook in terms of what you would expect from a large mineralized system. Simply put, it would be difficult for the data to look much better at this stage of the delineation process.

Also of note, the latest hole was targeted based on a radon anomaly found in samples collected from lake water and/or sediments. Think of radon as the smoke that comes off a fire. Uranium deposits generate radon gas as a natural process associated with the natural decay of uranium, so if you find high concentrations of radon gas, there's a decent chance that there's uranium associated with it. In the February 19th press release, the companies refer to yet another untested radon anomaly 2.2 kilometers east. The reason why I mention this is to point out just how early it is in terms of the exploration program. Seeing radon is not a "must have" to make a target worth drilling, but it's certainly in the "nice to have" category when it comes to ranking prospects.

Valuation

The natural questions that anyone would ask at this stage are: "How big is it?" and "How much is it worth?". These are the proverbial million dollar questions. Based on the existing drill data, it's impossible to know the answers to those questions with a high-degree of certainty, but we can look to history as a guide and draw parallels from it in order to "ballpark" the potential.

Fortunately recent history has provided a textbook case study in the form of Hathor Exploration. Without going into the nitty gritty details, Hathor's discovery was at 57 million pounds of U308 (and still growing) when it was bought by Rio Tinto in late 2011 for ~C$650 million. Hathor'sentire deposit was contained along a total strike length of about 300 meters. Right away, those of you paying attention will have noticed that AMW/FIS just hit on a 385 meter step-out, which arguably already gives Patterson Lake about 30% more strike length to work with despite the fact that the conductor corridor still has kilometers of untested strike length. This is not at all to say that the entire 400m strike length already defined at Patterson Lake will be mineralized, nor that the next 2+ kilometers will be mineralized, but it should start setting off lightbulbs over investor's heads as they realize a Hathor-size discovery (or potentially significantly larger) is well within the realm of possibility without the need for much imagination.

Granted PLS13-038 is only one of a handful of holes, but based on my experience, it would be highly unlikely that we would see mineralized thicknesses like this from a small, weak, or short-lived hydrothermal system. 57 meters of altered rock is approaching the height of a 20 storey building, and you simply cannot alter that thickness of rock to this degree without a big engine driving the fluid circulation that was responsible for depositing the mineralization.

Now, back to valuation: If we assume a hypothetical deposit of 50 million pounds of U308 and assume an in ground value of $10 per pound (Hathor was bought for more), a $500 million deposit value is not out of the question. For 100 million pounds, $1 billion would be possible.

Is $10 per "pound in the ground" reasonable? Consider this... aside form being just off an all season highway, the Patterson Lake mineralization isshallow. Depth counts in the mining business in a major way. For comparison, Hathor's deposit started at approximately 250 meters depth, while Patterson Lake mineralization appears to start at about one-quarter to one-third of that depth. That is a huge advantage when it comes to mining. Anyone who knows anything about mining will tell you how important a low strip ratio (ratio of overlying waste rock to mineralized rock) can be. My point is that at these depths, I believe Patterson Lake has the potential to be a highly attractive project and is at least worthy of a $10 per pound valuation. If this were a mine, I believe it would likely be one of the lowest cost operations out there.

In terms of shares outstanding, Alpha Minerals (the pure play) has about 25-26 million shares out on a fully diluted basis. Drilling is fast and cheap, and the mine planning for a shallow open pit would be relatively straightforward. I could see a scenario where AMW ended up with 30-35 million shares out at some point in the future. So, going back to a 50 million pound target, investors would be looking at $250 million in value to each of the 50/50 JV partners which would be in the $7-8/sh range for AMW. I am not throwing that number out there as a suggestion of where the stock should be trading immediately, but I do believe that is a rational medium to long term target for the stock if things keep going the way they have been (i.e., further delineation success). Additional discoveries could add to that number, but it's best not to put the cart too far in front of the horse. However, I will say that given what I've seen thus far, I believe that a hypothetical target of 50 million pounds may be conservative.

As for Fission, Fission has approximately 161 million shares out on a fully diluted basis. As part of Fission's deal with Denison (DNN) Fission shareholders have been offered 0.355 DNN shares for their non-Patterson Lake properties, valuing them at about C$75mm based on a C$1.36 DNN share price. Fission closed today with a C$0.95 share price, valuing the Fission "PLS stubco" at approximately $75mm as well. By that logic, Fission is currently undervalued by about 15c per share relative to Alpha, BUT the reason for that has to do with the fact that the Denison asset deal doesn't close until April (estimated) and there are always risks with any corporate deal, so expect a spread to persist until that deal closes.

In the meantime, investors are left with the choice of owning Alpha or Fission. For anyone who wants leverage to Patterson Lake, Alpha is the way to play it. As it stands today, anyone buying Fission is only deploying about half of their capital into the Patterson Lake stubco with the other half going into Denison stock as per the above explanation. This is why Alpha continues to outperform Fission on a percentage basis as more data comes out of Patterson Lake. In short, Alpha, as the pure play, leads the valuation and Fission is pulled along with it. I wrote on this effect in January (see the comments section below the article here), and I believe that the market has demonstrated my point exactly since that time.

Summary

Patterson Lake continues to impress. Additional drilling will be needed to prove out the ultimate size of the deposit, but all signs are pointing in the right direction. In terms of scarcity value, there simply is not an emerging deposit with as much size potential, in a jurisdiction like the Athabasca Basin, at these depths anywhere in the world that I am aware of, and that's a very good situation to be in with the macro winds blowing in the sails of the uranium market. As with any discovery story, this is still a speculative investment, but the data at this stage simply could not look better. Don't expect holes like this every week, but even holes 1/3 as good as this would be good enough for most people. This is undoubtedly hitting the radar of the majors of the world and one has to wonder just how long Patterson Lake will be left in the hands of these juniors if history is a guide.

I first described this as "The Athabasca Basin Discovery You Haven't Heard of - Yet". I think it's safe to say that a few people have heard of it and a few more are listening very closely now. Institutional interest is building, and I expect that some of the specialized funds with the ability to understand what the data is showing will start building positions going forward so as not to be caught flat-footed. The market cap should now be gaining the interest of ETF's like URA as well, which will make a tight float even tighter, particularly for Alpha holders.

More articles by Malcolm Shaw »

The Athabasca Basin Uranium Discovery That's Starting To Get Some (Warranted) AttentionThu, Feb 7Pan Orient Energy: Out Of The Frying Pan And Into The FireSat, Feb 2Choo-Choo! The (Pan) Orient Express Adds More Barrels To Its CargoThu, Jan 24The Athabasca Basin Heats Up - Fission Gets A Bid And Patterson Lake Drilling Is UnderwayThu, Jan 17The (Pan) Orient Express - A Highly Skewed Risk/Reward SituationThu, Jan 3