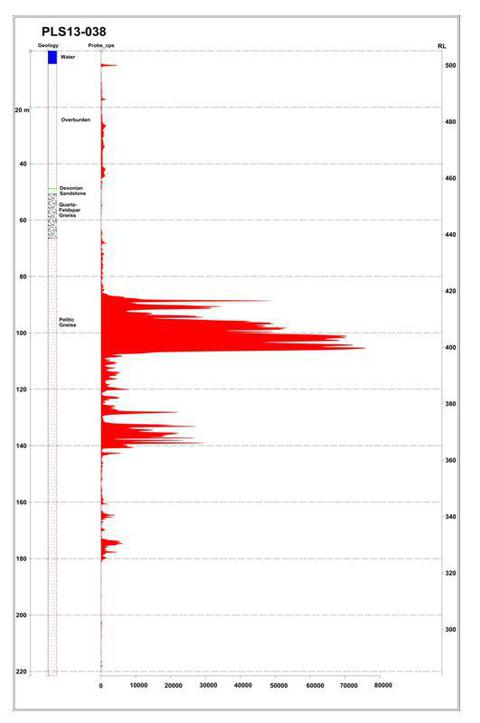

On February 19th, Alpha Minerals (ESOFD.PK and AMW on the TSX Venture) and Fission Energy (FSSIF.PK and FIS on the TSX Venture)announced a "game changing" drill result from hole PLS13-038 on their Patterson Lake project. 57.5 meters of strong mineralization was drilled starting at 87 meters depth, followed by 15m of additional intermittent mineralization starting at about 170m depth. This appears to be the best hole drilled at Patterson Lake so far, with descriptions of the mineralization being exactly what investors should want to see. Most importantly, this hole was drilled 385 meters east of the "discovery zone" where 37 meters of mineralization was previously reported. Assays are pending, but gamma probe measurements and core descriptions indicate high-grade uranium over significant widths (it should be noted that gamma probe readings are indicative of grade, but not predictive in an absolute sense). Patterson Lake maps and additional details can be found in the Alpha Minerals corporate presentation linked here.

Figure 1: Drill hole graphic showing consistent and highly radioactive mineralized intervals:

The uranium mineralization is being found along a geophysical conductor that has kilometers of strike length and the mineralization found to date remains open to expansion in all directions. The rock types and descriptions used in the press releases are textbook in terms of what you would expect from a large mineralized system. Simply put, it would be difficult for the data to look much better at this stage of the delineation process.

Also of note, the latest hole was targeted based on a radon anomaly found in samples collected from lake water and/or sediments. Think of radon as the smoke that comes off a fire. Uranium deposits generate radon gas as a natural process associated with the natural decay of uranium, so if you find high concentrations of radon gas, there's a decent chance that there's uranium associated with it. In the February 19th press release, the companies refer to yet another untested radon anomaly 2.2 kilometers east. The reason why I mention this is to point out just how early it is in terms of the exploration program. Seeing radon is not a "must have" to make a target worth drilling, but it's certainly in the "nice to have" category when it comes to ranking prospects.

Valuation

The natural questions that anyone would ask at this stage are: "How big is it?" and "How much is it worth?". These are the proverbial million dollar questions. Based on the existing drill data, it's impossible to know the answers to those questions with a high-degree of certainty, but we can look to history as a guide and draw parallels from it in order to "ballpark" the potential.

Fortunately recent history has provided a textbook case study in the form of Hathor Exploration. Without going into the nitty gritty details, Hathor's discovery was at 57 million pounds of U308 (and still growing) when it was bought by Rio Tinto in late 2011 for ~C$650 million. Hathor'sentire deposit was contained along a total strike length of about 300 meters. Right away, those of you paying attention will have noticed that AMW/FIS just hit on a 385 meter step-out, which arguably already gives Patterson Lake about 30% more strike length to work with despite the fact that the conductor corridor still has kilometers of untested strike length. This is not at all to say that the entire 400m strike length already defined at Patterson Lake will be mineralized, nor that the next 2+ kilometers will be mineralized, but it should start setting off lightbulbs over investor's heads as they realize a Hathor-size discovery (or potentially significantly larger) is well within the realm of possibility without the need for much imagination.

Granted PLS13-038 is only one of a handful of holes, but based on my experience, it would be highly unlikely that we would see mineralized thicknesses like this from a small, weak, or short-lived hydrothermal system. 57 meters of altered rock is approaching the height of a 20 storey building, and you simply cannot alter that thickness of rock to this degree without a big engine driving the fluid circulation that was responsible for depositing the mineralization.

Now, back to valuation: If we assume a hypothetical deposit of 50 million pounds of U308 and assume an in ground value of $10 per pound (Hathor was bought for more), a $500 million deposit value is not out of the question. For 100 million pounds, $1 billion would be possible.

Is $10 per "pound in the ground" reasonable? Consider this... aside form being just off an all season highway, the Patterson Lake mineralization isshallow. Depth counts in the mining business in a major way. For comparison, Hathor's deposit started at approximately 250 meters depth, while Patterson Lake mineralization appears to start at about one-quarter to one-third of that depth. That is a huge advantage when it comes to mining. Anyone who knows anything about mining will tell you how important a low strip ratio (ratio of overlying waste rock to mineralized rock) can be. My point is that at these depths, I believe Patterson Lake has the potential to be a highly attractive project and is at least worthy of a $10 per pound valuation. If this were a mine, I believe it would likely be one of the lowest cost operations out there.

In terms of shares outstanding, Alpha Minerals (the pure play) has about 25-26 million shares out on a fully diluted basis. Drilling is fast and cheap, and the mine planning for a shallow open pit would be relatively straightforward. I could see a scenario where AMW ended up with 30-35 million shares out at some point in the future. So, going back to a 50 million pound target, investors would be looking at $250 million in value to each of the 50/50 JV partners which would be in the $7-8/sh range for AMW. I am not throwing that number out there as a suggestion of where the stock should be trading immediately, but I do believe that is a rational medium to long term target for the stock if things keep going the way they have been (i.e., further delineation success). Additional discoveries could add to that number, but it's best not to put the cart too far in front of the horse. However, I will say that given what I've seen thus far, I believe that a hypothetical target of 50 million pounds may be conservative.

As for Fission, Fission has approximately 161 million shares out on a fully diluted basis. As part of Fission's deal with Denison (DNN) Fission shareholders have been offered 0.355 DNN shares for their non-Patterson Lake properties, valuing them at about C$75mm based on a C$1.36 DNN share price. Fission closed today with a C$0.95 share price, valuing the Fission "PLS stubco" at approximately $75mm as well. By that logic, Fission is currently undervalued by about 15c per share relative to Alpha, BUT the reason for that has to do with the fact that the Denison asset deal doesn't close until April (estimated) and there are always risks with any corporate deal, so expect a spread to persist until that deal closes.

In the meantime, investors are left with the choice of owning Alpha or Fission. For anyone who wants leverage to Patterson Lake, Alpha is the way to play it. As it stands today, anyone buying Fission is only deploying about half of their capital into the Patterson Lake stubco with the other half going into Denison stock as per the above explanation. This is why Alpha continues to outperform Fission on a percentage basis as more data comes out of Patterson Lake. In short, Alpha, as the pure play, leads the valuation and Fission is pulled along with it. I wrote on this effect in January (see the comments section below the article here), and I believe that the market has demonstrated my point exactly since that time.

Summary

Patterson Lake continues to impress. Additional drilling will be needed to prove out the ultimate size of the deposit, but all signs are pointing in the right direction. In terms of scarcity value, there simply is not an emerging deposit with as much size potential, in a jurisdiction like the Athabasca Basin, at these depths anywhere in the world that I am aware of, and that's a very good situation to be in with the macro winds blowing in the sails of the uranium market. As with any discovery story, this is still a speculative investment, but the data at this stage simply could not look better. Don't expect holes like this every week, but even holes 1/3 as good as this would be good enough for most people. This is undoubtedly hitting the radar of the majors of the world and one has to wonder just how long Patterson Lake will be left in the hands of these juniors if history is a guide.

I first described this as "The Athabasca Basin Discovery You Haven't Heard of - Yet". I think it's safe to say that a few people have heard of it and a few more are listening very closely now. Institutional interest is building, and I expect that some of the specialized funds with the ability to understand what the data is showing will start building positions going forward so as not to be caught flat-footed. The market cap should now be gaining the interest of ETF's like URA as well, which will make a tight float even tighter, particularly for Alpha holders.

More articles by Malcolm Shaw »

The Athabasca Basin Uranium Discovery That's Starting To Get Some (Warranted) AttentionThu, Feb 7Pan Orient Energy: Out Of The Frying Pan And Into The FireSat, Feb 2Choo-Choo! The (Pan) Orient Express Adds More Barrels To Its CargoThu, Jan 24The Athabasca Basin Heats Up - Fission Gets A Bid And Patterson Lake Drilling Is UnderwayThu, Jan 17The (Pan) Orient Express - A Highly Skewed Risk/Reward SituationThu, Jan 3

Stockhouse; FIS board:

BeantwoordenVerwijderen----------------------

my thoughts.

Nosleep4

2/21/2013 10:14:38 AM | | 251 reads | Post #32213281

Rate this

clarity

5

overall quality

4

credibility

5

usefulness

5

After reviewing that step out hole and discussing it with a few people i have a pretty good feeling of what "could happen" if the assays come back as I'm hoping they will. Honestly it should be a repeat of HAT again on the PLS property. PLS could become one of the most important properties in the basin simply because of depth. If anyone is going to develop something there i would think they'd want to do it at the 50-200 metre level instead of 300-1100 metres. I'm not quite sure the market understands the importance of the depth here quite yet...

I'm happy to get what we get from DML and then just ride PLS newco. I have no doubt that DML will then be taken out by bigger fish at some point also, so there's plenty of upside left in it also.

I think we could see a bidding war whether we like it or not as I'm not sure how a major that's serious about it's business in the Basin can ignore results like we've come up with. Maybe they will wait for final assays? Why wouldn't a major throw out a bone at 1.10, that's a good 20% more than today's valuation. They could steal PLS and still get J zone cheap. It's not that i think we're only worth that, it's just the way things go. I don't think anyone would be happy with the offer, and it probably would get turned down but it might still happen.

As i said over on the HAT board for years, pound will pile up in a hurry if you get big grades over lengths of 20-60 metres. If the new discovery hole is 5% + and it hits on some stepouts you could be looking at 10-20 million pounds in that area almost instantly. If it's connected and not just a separate pod from the initial discovery zone then we're in an entirely new ball game. IF and it's an enormous IF, the deposit is all connected and continuous then we're looking at a life changing event, lol. I would be shocked if it was all connected, but who knows. 385 metres is a solid distance, odds are slim, but it would be incredible.

Next step here is likely assays and step-outs from new discovery hole. If they hit more holes on 10-15 metre stepouts over long lengths then the game is really on. Valuation is simple. I will use the same thing i did with HAT, 10 bucks per projected pound. If i think PLS is going to have 50 million pounds then you've got 250 million MC per company for PLS only. So for fis shareholders you would have to add your DML valuation.

Those valuations could increase dramatically depending on many things i have discussed here. It's way too early to start guessing though, we still don't have assays or stepouts on the new discovery and i'd like to see solid stepouts on the initial discovery, this is far from a deposit yet.

It's pretty exciting though, Roughrider was considered a once in a lifetime event by most Geologists. Imagine being part of multiple world class discoveries like this in under 5 years time. Gotta be fun times for the gang in the basin. The Basin is a special place. Special deposits are found there, maybe we got one by the tail!

Nosleep

Read more at http://www.stockhouse.com/bullboards/messagedetail.aspx?p=0&m=32213281&l=0&r=0&s=FIS&t=LIST#43yMx8KGbSZv4vip.99

Fission Energy Corp.: 4 Step-Out Holes Hit Off-Scale; Expand Discovery Zone to 50m Wide

BeantwoordenVerwijderenMarketwirePress Release: MINING EXPLORATION UPDATE – 1 hour 53 minutes ago

Symbol Price Change

FIS.V 0.94 0.04

KELOWNA, BRITISH COLUMBIA--(Marketwire - Feb. 25, 2013) - FISSION ENERGY CORP. ("Fission" or "the Company") (TSX VENTURE:FIS)(FSSIF) and its Joint Venture partner Alpha Minerals Inc. are pleased to announce results from a further 10 holes completed in the Winter 2013 exploration program at the Patterson Lake South (PLS) property.

In close spaced delineation drilling, an additional 5 holes have been completed in the area west of the November 2012 discovery on Line 000. All 5 of the holes are mineralized. As well, 5 close-spaced holes were drilled from 90 to 105m east of Line 000. Results show well developed alteration in all 5 holes and weak mineralization in 2 holes on Line 090E (PLS13-028 and 032).

Drilling Highlights include:

Expansion of the flat-lying, shallow depth on L025W to ~50m width, north-south. The zone remains open in all directions.

PLS13-029 (L025W): 34.0m interval of continuous mineralization; including discrete intervals totaling of 1.88m of "off-scale" radioactivity (> 9999 cps)

PLS13-031 (L025W): 26.0m interval of continuous mineralization; including discrete intervals totaling 1.54m of "off-scale" radioactivity (> 9999 cps)

PLS13-035 (L010W): Two intervals of continuous mineralization of 9.5m wide each; including discrete intervals totaling 0.85m of "off-scale" radioactivity (> 9999 cps)

PLS13-037 (L025W): 23.0m of intermittent mineralization; a deeper zone (103.0 - 126.0m), including narrow intervals of "off-scale" radioactivity (> 9999 cps)

Alteration and associated weak mineralization on 100m east on-trend step-out shows potential to host high grade mineralization within favorable lithology along strike to the east.

4 Holes have been selected for pre-collaring along line 385 where the large high grade intersection of uranium was reported on in the previous news release (Feb 19th 2013).

Ross McElroy, President, COO, and Chief Geologist for Fission, commented,

"In what is proving to be a very active and fruitful winter program at PLS, we continue to be encouraged as we see results that extend the initial zone of mineralization as well as the potential of a new mineralized zone 115m to the east. Our technical team is working extremely hard to process the information we receive from each new result and to design our plan to take the fullest advantage of this opportunity."

Discovery Area

The area refers to the region of mineralization where initial discovery holes (PLS12-022, 023, 024 and 025) were drilled, as well as the recently announced 2013 holes PLS13-026 and 027 (see news release Feb 07, 2013) and is so far delineated over land near the western shore of Patterson Lake. A total of 5 additional close spaced step-out holes were drilled in the area; 4 holes on line 025W and 1 hole on line 010W (PLS13-035). All 5 holes intersected mineralization at a shallow depth in the Archean basement. Refer to Table 1 for drill hole collar and mineralization summary. Mineralization generally develops within chlorite and hematite altered basement rocks and is characterized by pitchblende in the form of flecks, blebs, clots and veins. Basement lithology is generally metapelites (+/- graphite), and occasional metasemipelites, often with narrow intervals of pegmatite. The discovery area is open in all directions and additional drilling is required to continue to delineate the mineralized area.

De koersen van Fission (83 cent) en Alpha Minerals (3,34) zijn gisteren wat gecorrigeerd, sommigen hadden kennelijk nog betere boorresultaten verwacht.

BeantwoordenVerwijderenDeze correctie biedt wellicht een fraaie kans om alsnog in te stappen, want er komt een forse stroom nieuws uit op korte termijn.

Bij FIS kan bovendien nog een biedingsstrijd ontstaan.

Het boorresultaat van ca 58 m uraniumerts met hoog gehalte duidt erop dat men wellicht een van de grootste Ur-vondsten in de Athabasca-area ooit heeft gevonden.

Door de geringe diepte gaat het boren heel snel; een boring duurt meestal slechts 2 dagen.

Heb gisteren nog wat stukjes bijgekocht.

BeantwoordenVerwijderenGisteren wat insider sales geweest bij AMW/FIS, zie link (http://www.tmxmoney.com/HttpController?GetPage=InsiderTradeMarker&Market=V&Language=en) komt later op Canadian Insider, zal wel stukjes zijn van de warrants die onlangs zijn uitgeoefend of Inwentash (Pinetree Capital) die wat stukken verzilverd heeft.

Mensen zijn daarnaast ook ongeduldig en willen de assays zien, als ik zo de BB volg hier en daar. Ik hou mijn aandelen voorlopig nog even vast.

Dit is de nieuwe presentatie van AMW - http://www.alphaminerals.ca/images/Alpha_Minerals_Inc_Feb_25.pdf

Mooie foto's van hole 38.

G-member,

Verwijderenik zie geen insiderverkopen, alleen een uitoefening van warrants door Inwentash, dus warrants uit, aandelen in.

Yep op Canadian Insider zie je dus nog geen insider sales dus alleen het gene wat jij zegt. Op de TMX Money site zie je dat op 26 feb. bijna 100.000 aandelen AMW zijn verkocht door ''insiders'' wie dat zijn dat weet ik niet. Ik vermoed Inwentash/Pinetree.

VerwijderenToen GCU.V 2 jaar geleden aan zijn opmars bezig was, bleek Inwentash/Pinetree bijna elke dag het aandeel op te kopen en dit werd weken er na pas gerapporteerd op Canadian Insider. Ze hadden inderdaad miljoenen opgekocht ''on market'' als via PP. TMX Money was toen erg accuraat en was voor mij een goede tool om te gebruiken.

Als het goed is zal het op Canadian Insider moeten verschijnen.

Inwentash heeft idd. een ruime 200.000 aandelen verkocht de afgelopen week, vandaar de koersdruk.

Verwijderenhttp://www.canadianinsider.com/node/7?menu_tickersearch=AMW+%7C+Alpha+Minerals

zeg precies, toevallig nog een mening over lakeland resources v.lk? net wat grond verkregen in de athabasca basin en een lage mc. gr. Seadoc

BeantwoordenVerwijderenHallo Seadoc,

VerwijderenLakeland ken ik niet, bij een grote vondst zijn er altijd bedrijven die willen meeprofiteren van de plotselinge belangstelling voor een gebied.

Zeker in dit geval geloof ik daar niet in, FIS/AMW hebben alleen zo (relatief) snel succes kunnen boeken dankzij de gevonden zwerfkeien met ca 40% Ur.

Zonder deze bijzondere omstandigheden had het zoeken vele jaren langer geduurd en had ik geen aandelen ESO/AMW in een vroeg stadium gekocht.

ok, helder, precies bedankt voor je antwoord.

BeantwoordenVerwijderenHet aandeel is weer in een vrije val vandaag, mogelijk weer insider sales of gewoon winstnemers?

BeantwoordenVerwijderenHoppa weer 192.200 aandelen gedumpt door een insider volgens TMX Money website.

Verwijderenhttp://www.tmxmoney.com/HttpController?GetPage=InsiderTradeMarker&Market=V&Language=en

PDAC-Alpha Minerals looks to strike it rich in Athabasca, again

BeantwoordenVerwijderenMon Mar 4, 2013 12:25pm EST

* Shares soaring on drill results since November

* Gains are in sharp contrast to most of industry

* Uranium prices depressed since Japanese disaster

* Alpha led by part of Hathor Exploration team

By Rod Nickel

TORONTO, March 4 (Reuters) - The last uranium company Ben

Ainsworth worked for, Hathor Exploration, became the target of a

bidding war that mining giant Rio Tinto PLC eventually

won, and the geologist-turned mining executive thinks he may

have struck it rich again.

Ainsworth is now chief executive of Alpha Minerals Inc

, a junior miner that has a closely watched joint venture

project with Fission Energy Corp in Western Canada's

uranium-rich Athabasca basin.

The companies are in the early stages of exploring their

deposit at Patterson Lake South, but drill hole results in

November and again in February sent Alpha's stock on a tear.

Shares of the Vancouver-based company have multiplied in value

eight times since Nov. 5. It has also raised C$9 million ($8.7

million) in private placements and exercised stock warrants,

funding it into early 2014.

Alpha's gains stand in sharp contrast to declines among many

uranium stocks, such as Cameco Corp, the world's

largest listed uranium producer, due to soft prices following

Japan's Fukushima disaster two years ago. Despite those

conditions, and pressures on the global mining sector in

general, investors can still get excited about uranium given a

compelling reason, Ainsworth said.

Alpha was known as ESO Uranium Corp until Nov. 2, when it

consolidated shares in the renamed company, Alpha. The tight

share structure also contributed to the price spike.

"There definitely was a great response," Ainsworth said.

"It's really helpful to have some momentum going forward after

you've completed the (share) rollback and come back trading."

2)

BeantwoordenVerwijderenResults at five drill holes of relatively shallow depth,

suggested to some that Alpha's flagship project Patterson Lake

South could become Athabasca's next high-grade uranium deposit.

The work is so preliminary, however, that Alpha and Fission do

not yet have a legally defined resource.

"The grades and the thicknesses become very significant,

especially when you put it at fairly shallow depth," Ainsworth

said, adding that means less digging for a potential open pit

mine.

The results showed an attractive deposit at Patterson as

shallow as 50 metres below the surface. Hathor's Roughrider

deposit is five times as deep.

Alpha and Fission were initially partners on exploring a

property further north when their geophysics contractor

suggested the deposit may be bigger than they thought.

"We started to find the information for the south (property)

looking a heck of a lot more interesting," Ainsworth said.

Ainsworth, a geologist and engineer, was vice-president of

exploration at Hathor Exploration, which developed the

Roughrider uranium deposit in the basin before selling the

company last year to Rio Tinto, who outbid Cameco. He later

brought along Michael Gunning, Hathor's former CEO, as Alpha's

chairman.

"That certainly added to our ability to run up the old

Hathor flag and say, 'look, we've got parts of the Hathor team

here and we may be able to do something like that.'"

Fission, which is being acquired by Denison Mines Corp

pending a shareholder vote, is preparing for Patterson

Lake South a 43-101, an instrument to publicly disclose

information about Canadian mineral properties. The takeover does

not include Fission's half interest in Patterson Lake South,

which will be owned by a newly formed company.

A producing mine at Patterson could be less than a decade

away, Ainsworth said, subject to a preliminary economic

assessment, feasibility studies and permit approvals.

"Fortunately we are in one of the best parts of the world

politically, and geologically it's a super part of the world.

"This is where the highest-grade mines in the world are."

The world's biggest mining convention, held by the

Prospectors & Developers Association of Canada, takes place

this week in Toronto.

BeantwoordenVerwijderenUranium Consolidation – More To Come?

By Iain Butler - March 5, 2013 | See also: DMLFIS

Currently, the primary theme impacting the world of mining and resources is that of financing – specifically, the lack thereof. Consolidation in the uranium space is another emerging theme that is not attracting as much attention.

The price of uranium is low. At $42/lb or so, the commodity trades well below its marginal cost which sits up in the $60 or $70 range. Many believe that the depressed price is temporary and will rebound once the nuclear industry regains its footing after the Fukushima disaster in Japan. Smart corporate players are beginning to position themselves for this rebound.

Back in mid-January, a seemingly opportunistic bid to takeout one of the industry’s more prospective junior players occurred. ARMZ, a Russian state-owned uranium miner is in the process of acquiring Uranium One (TSX:UUU). Around the same time, Fission Energy (TSXV:FIS) and Denison Mines (TSX:DML) struck a deal that is expected to close in April. This Fission/Denison deal appears far more favourable to Fission shareholders than the Uranium One deal was to that company’s shareholders.

Details

For each share owned, Fission shareholders will receive .355 shares of Denison as well as 1 share of a newly created company that will hold some of Fission’s more prospective exploration projects, as well as $15 million in cash and Fission’s current management team.

In exchange for its shares, the big asset that Denison is getting back is Fission’s stake in a project known as Waterbury Lake. This will leave Denison as the 60% owner of the project, with Korean utility Kepco owning the other 40%. The Waterbury Lake project sits directly adjacent to Rio Tinto’s Roughrider project, a deposit that they acquired by purchasing Hathor Exploration (after outbidding Cameco) back in 2011 for more than $600 million.

Shareholders

Fission is effectively selling itself – just like Uranium One did. The reason this deal is more appealing for Fission’s shareholders than the UUU deal is that FIS owners are receiving shares, not cash. UUU owners are being taken out of their position with cash at potentially the worst time, given the low commodity price.

It is widely believed that with this more consolidated Waterbury Lake project in its stable, Denison is now itself a viable takeout candidate. Fission shareholders stand to benefit from this.

In addition, one of the early stage assets (Patterson Lake South (PLS)) that will be 50% owned by the new exploration company that Fission shareholders will hold, has had tremendous initial drill results. This transaction will potentially unlock the value embedded within this asset as the other owner of PLS, Alpha Mineral Resources (TSXV:AMW), has seen its shares climb by over 900% during the past 6 months because of the successful drill results. Rather than being taken out of the game like UUU’s shareholders, Fission shareholders are still very much alive and kicking.

The Foolish Bottom Line

A decent size list of companies that could be next in line for a corporate transaction in the uranium space exists. To help your search, there are two themes that you can focus on. One, seek out management teams that have pulled off shareholder friendly transactions in the past. The other, look for companies with substantial resource bases in politically stable areas. Majors tend to favour these rare assets.

With its shareholder friendly deal to sell itself in place, Fission’s management easily qualifies for theme number one. In addition, the team with whom Fission shares the promising Patterson Lake project with is none other than the team that led Hathor and the Roughrider project into its bidding war between Cameco and Rio Tinto. Seemingly, current Fission shareholders are in good hands!

RE: RE: RE: RE: Assays 5-6 weeks

BeantwoordenVerwijderenChattyc2

3/7/2013 12:10:52 PM | | 57 reads | Post #32288523

Rate this

clarity

5

overall quality

4

credibility

5

usefulness

5

Looking at hole # 38, it has 20 meters continuous, of plus 10,000 scint readings from the hand held device or has 10 meters continuous scint readings from the down hole probe.

Now here's where it gets interesting:

I'm just going from memory here, but didn't the upper part of hole # 38 where that red ocean of scint readings raptor7 just posted, have cps counts up to 75,000 and many above 47,000. That is a long ways above the 10,000 mentioned. The down hole probe gives these higher readings from mineralization in the drill hole and outside the drill hole in the basement rock surrounding such, compared to the hand held that just reads the drill-core when it is pulled above ground, and maxes out at 10,000.

Remembering from the HAT days, when they reported scint readings like these, the actual assays were as high as 50% and above in places where they got these very high scint cps readings. I don't think HAT had 10 meters of continuous off-scale down hole probe readings up to 75,000 like hole # 38 has, or the 20 meters of continuous mineralization above 10,000 off-scale hand held scint readings.

Bottom line ...... cps readings up to the 75,000 range are consistent with hi-grade U308 that are way way beyond 1% 2% 5% 10% when the assays arrive. What the entire hole # 38 grades should be spectacular as it is 57.5 meters of continuous mineralization. This very hi-grade section will boost the overall grade of the hole, top to bottom.

This is why AMW is trading above $3.00 instead of .30 cents with just scint readings announced so far, as people in the industry know what's what and what is probably enroute from the lab.

P.S..... don't forget hole # 27 of 37 meters of continuous mineralization with off-scale scint readings currently in the lab hopper.

Read more at http://www.stockhouse.com/bullboards/messagedetail.aspx?s=AMW&t=LIST&m=32288688&l=0&pd=1&r=0#Lm6aSKPukqeAX1cJ.99

Precies,

BeantwoordenVerwijderenIk begin bij Fission steeds meer vibes op te pikken (ook online) á la Hathor, en ik ben benieuwd hoe jij het AMW/FIS spel momenteel speelt. Ben je aan het bijkopen? Ikzelf heb aardig wat Fission (vanaf de 0.70-regio's), maar kijk momenteel of ik bij zal kopen of AMW aanschaf. Of helemaal niets doe natuurlijk. Alvast bedankt.

Hallo Hendrik,

VerwijderenIk zit al heel lang in beiden (in ESO/AMW vanwege de zwerfkeien) en af en toe koop ik wat bij en verkoop ik wat bij hoge(re) koersen.

In feite zijn dit de enige Ur-aandelen waar nog wat te beleven valt.

Een berg Ur-erts met een hoogte van ca 20 verdiepingen maakt dit project heel spannend.

De halve overname van Fission gaat waarschijnlijk door (gezien het bericht van vandaag) en dan krijg je aandelen Denison + Fission Uranium.

Veel plezier!

The Anatomy Of A Uranium Deposit

BeantwoordenVerwijderenMar 7 2013, 18:47 | 2 comments | includes: ESOFD.PK, FSSIF.PK

Disclosure: I am long ESOFD.PK. (More...)

What Does a Uranium Deposit Look Like?

Given the attention swirling around the Patterson Lake discovery made by 50/50 partners Fission Energy (FSSIF.PK, or FIS on the TSX Venture) and Alpha Minerals (ESOFD.PK, or AMW on the TSX Venture), I thought it might be timely to provide some context with respect to the shapes of uranium deposits. In particular, I believe that the footprint of these deposits is important to understand when dealing with an early stage discovery. It is far too early to talk in specifics, so I'll use an existing deposit as an illustration.

Uranium deposits are formed where uranium-bearing fluids meet a chemically reducing rock-type, typically in areas of fracturing and/or faulting. The fractures and faults provide pathways for the uranium-bearing fluids to flow, while the reducing agent causes the uranium to fall out of solution and be deposited. In the case of Patterson Lake, the graphitic metapelite in the area appears to be the primary reducing agent, but there are also other rock types that can fulfill this role chemically. The main point that I'm trying to get across is that these are fluid- and fracture-controlled deposits, so don't expect them to behave "neatly." This is important when looking at drill hole data at an early stage, and I think it is best illustrated with a picture.

Below is an image taken from the Denison Mines corporate presentation. The image is of its Wheeler River Phoenix "A" Zone. I am not presenting this to make a comparison in terms of grade or size, but simply to illustrate the view of the deposit and how the interpretation of its shape changed over time. In the left frame is a top-down view from November 2010, while in the right frame is a top-down view of the same deposit after additional drilling 2 years later. The main thing I want to point out this the variability in the width of the "white" zone (which is the best grade in this case). Note how it pinches (thins) and swells (thickens). As more data was obtained, the deposit looked less like a uniform sausage and more like something a little more irregular, as it should, given these deposits are fluid-, fracture-, and fault-controlled.

(click to enlarge)Figure 1: Map View of Wheeler River Phoenix A Zone

2)

BeantwoordenVerwijderenSummary

It's early days at Patterson Lake for Fission and Alpha, but I have always believed that the more information and context one can have, the better. Based on conversations with people familiar with the Patterson Lake story, it became clear to me that most didn't appreciate the shape of a fracture/fault controlled deposit, so I'm presenting this deposit example as a framework for people to think about as the drill program progresses.

There is a lot of drilling left to do, but the early indications are that all of the elements necessary for forming a material uranium deposit (or deposits) are there. These indications are: 1) significant alteration over significant widths in favorable rock types, 2) uranium mineralization associated with this alteration (some of which appears to be very high grade), 3) mineralization already proven in two areas separated by 400 meters of strike, 4) significant untested strike length along a proven prospective corridor, 5) multiple as yet undrilled geophysical and geochemical (radon) targets along that corridor.

Beyond that, the future has yet to be written, but there's little doubt that Patterson Lake looks like it has the right zip code to deliver the goods. Knowing what a deposit looks like, or can look like, is critical in the early stages of discovery so as to avoid overestimating or underestimating the importance of any given drill hole. The key element that investors should want to see going forward is the expansion of existing mineralized zones either on land or in the lake... as long as that's the case, "pounds are being added," which is what drilling is all about.

http://seekingalpha.com/article/1257751-the-anatomy-of-a-uranium-deposit

VerwijderenAlpha Minerals Hits 53.0m of Radioactivity With 13

BeantwoordenVerwijderenthinkahead2

3/11/2013 12:19:19 PM | | Post #32305442

Alpha Minerals Hits 53.0m of Radioactivity With 13.89m of "Off-Scale" in a 15 Meter Step-Out Hole at Patterson Lake South

VANCOUVER, BRITISH COLUMBIA--(Marketwire - March 11, 2013) - ALPHA MINERALS INC (TSX VENTURE:AMW) ("Alpha" or "the Company"), and its 50% joint venture partner, Fission Energy Corp are pleased to announce results from 5 additional drill holes, including 3 holes (PLS13-044, 046 and 051) from Zone R390E, located approximately 390m east of the PLS12-022 discovery hole referred to now as Zone R00E on the Patterson Lake (PLS) property. These results have extended the strike length of Zone R390E by 15 m. Additional drilling is ongoing.

Drill holes PLS13-044, 046, and 051 were drilled as offsets to the previously reported PLS13-038 hole (see new release dated Feb. 19th, 2013) in order to determine the orientation and strike of Zone R390E. Zone R390E remains open and additional step-out drilling is now underway along strike.

Zone naming by Alpha has been based on naming a significant line of the Drill Grid by its Easting or Westing along the base line, which intersects what may be a discrete mineralized body, so that the reader may have sense of the distance between zones. A Zone 60E would be 60m east of Zone R00E - A Zone 120W would be 120m west of Zone R00E.

ZONE R390E

Drilling Highlights Include:

53.0m interval of continuous radioactivity in hole PLS13-051;

including 11.5m of continuous "off-scale" radioactivity (>9999 cps)

the sum of discrete intervals of "off-scale" radioactivity total 13.89m

>26% of the interval gives "off-scale" readings.

PLS 13-051 is located 15m grid east of PLS13-038 (see news release dated Feb. 19, 2013) in which radioactivity was found over 57.5m. 11.65m of which was "off-scale".

PLS13-044, drilled 10m north of PLS13-038, intersected four discrete zones of variable weak to locally strong radioactivity ranging from 3.0 to 17.0m in length.

ZONE R390E see refers to the zone of radioactivity located on Line 390E which is approximately 390 meters eastwards along the same conductor as the first discovery holes at Zone R00E on the west side of Patterson Lake. Off-Scale and extensive Radioactivity was first encountered in PLS13-038 (see news release Feb 19, 2013). Zone R390E has now been indicated with 4 drill holes (PLS13-038, 044, 046 and 051) and is open in all directions. Based on geophysical interpretations of airborne and ground EM surveys and ground resistivity surveys, the general target area of Zone R390E is along the strike of a conductor that extends from the western radioactivity located at Zone R00E to the west. As is the case with the Zone R00E, Zone R390E is located to the north of the PL-3B basement EM conductor and situated within a well defined resistivity low corridor. Drill hole PLS13-038 tested a coincidental radon in water and radon in sediment anomaly along this conductor trend. Drill hole interpretation thus far defines the area of radioactivity to be associated with a steeply dipping pelitic (+/- graphitic) lithology sandwiched between a semipelitic gneiss to the north and a quartz-feldspar gneiss to the south, where the radioactivity is focused primarily near the contact between the pelitic gneiss and quartz-feldspar gneiss.

Read more at http://www.stockhouse.com/bullboards/messagedetail.aspx?p=0&m=32305442&l=0&r=0&s=AMW&t=LIST#6rBZaxtJLTB3w0Vr.99

http://www.fission-energy.com/i/pdf/Gamma-log/PLS13-051-Up-Hole-Triple-Gamma-Log.pdf

Verwijderen

BeantwoordenVerwijderenPatterson Lake Delivers... Are Investors Home?

Mar 12 2013, 08:38 |

Patterson Lake Update

50/50 JV partners Alpha Minerals (ESOFD.PK or AMW on the TSX Venture) and Fission Energy (FSSIF.PK or FIS on the TSX Venture) released an update on Monday (March 11th) regarding step-out drilling progress on the Patterson Lake South property. The results extended the "east zone" 15 meters to the east (now called Zone 390E) and the zone remains open to expansion. The reported PLS13-051 hole showed the longest continuous off-scale interval encountered to date on the property. These are the first step out holes drilled in the area surrounding hole PLS13-038, which previously hit 57.5 meters of high grade mineralization, including 10.65 meters of off-scale mineralization.

The highlight hole (PLS13-051) was a 15m step-out which extends this recently discovered zone to the northeast. PLS13-051 showed a 53 meter interval of continuous radioactivity, including 13.9 meters of "off-scale", the most seen to date in any drill hole on the property. Within that 13.9 meters, was an 11.5 meter interval of continuous off-scale mineralization, which is again the thickest such interval seen to date in any drill hole on the property. Two other holes were reported around PLS13-038; one to the south (PLS13-046) which was outside of the mineralized zone and one to the north (PLS13-044) which appears to have hit the edge of the zone. Both holes were drilled to help determine the orientation of the zone, which then led to the drilling of the highly mineralized PLS13-051 step-out hole. Compared to hole PLS13-038, the PLS13-051 step out shows remarkable consistency and is highly correlative. This bodes well as it shows a "consistent and mineralized" zone, which may mean it will be traceable over additional strike.

In what can only be described as perplexing market action, both Fission and Alpha are actually trading down on this news as I write this. Trying to understand why shareholders would sell on the back of news that is confirming the very exploration model that they were invested in in the first place is a mindbender. It could perhaps be that investors were hoping to see a "wider" zone than what is currently indicated based on the limited available drill data. If that is the case, it can only mean that those investors have little understanding of the nature of fracture/fault hosted uranium deposits.

2)

BeantwoordenVerwijderenFor those looking for deeper context on such a deposit, there are numerous resources available on the web, one of which is a presentation on the history of the Key Lake and McClean Lake areas linked here. An example of a fault controlled basement deposit is shown below (clipped from the linked presentation). The mineralization concentrates along fault zones, which are typically narrow and often high grade.

As an example, Denison's (DNN) Wheeler River deposit, from the figures in their presentation materials, has a high grade core that appears to be in the 10-20m width range in plan view (see my prior article here), which is comparable to what has been seen in the early holes around PLS-13-038. Furthermore, Cameco's (CCJ) giant McArthur River deposit is on average 12.7 meters thick (see the McArthur River 43-101 report here). I reference Wheeler River and McArthur River simply to illustrate what a fracture and fault controlled uranium deposit looks like in terms of shape, width, and variability (the deposit types may be quite different in other respects). Without appreciating the geometry and nature of other uranium deposits, investors are handicapping themselves in terms of interpreting Patterson Lake data going forwards. To put it bluntly, in any rational evaluation of the results released today (and based on any rational expectations) today's news is at worst confirmatory in nature, which simply may not be good enough in a junior mining market that can only be described as brutal.

Two additional holes were also reported from regional reconnaissance drilling on two target areas approximately 2 kilometers to the northeast. Both holes encountered significant clay alteration, but no mineralization. Hitting mineralization on a step out that far away on the first hole would be akin to hitting a hole in one from the tee on a par 4, if not a par 5. The clay alteration should not be discounted. Clay alteration is commonly seen in regions of hydrothermal activity and may suggest proximity to a mineralizing system. There is also a lack of sandstone cap rock in that area, which is one of the prerequisites for the yet-to-be-found boulder source area. Numerous targets remain to be tested in that region and the company has stated that future drilling is planned in the area. I find it hard to believe that these reconnaissance drill holes could have anything to do with the trading action after the news either.

3)

BeantwoordenVerwijderenSummary

As long as drilling continues to prove up mineralization "pounds are being added" and the geological and exploration model is being validated. Over-analyzing market reactions on a day-to-day basis is typically a navel-gazing exercise, but I believe my point is clear. The news released today is unquestionably positive and at worst confirmatory in nature and with two rigs drilling and assay results getting closer by the day, information is coming in quickly. A deposit that combines high grade and shallow depth with a low strip ratio is an ideal scenario in the mining sector and each data point adds to the story developing at Patterson Lake. To be sure, Patterson Lake can only be characterized as speculative by its nature, but both partners are well-funded and the uranium macro winds appear to be set to lift the sector beginning sometime in H2 2013.

The data continues to impress. I simply can't recall an exploration story with results like these at depths like these in the uranium sector in recent memory. As always, price and information are correlated over the medium and long term in the mining sector. The more information that is available, the more efficiently priced an asset becomes. Assay data should start coming in soon, but most informed investors have likely already formed opinions on potential grade based on core descriptions given so far in the 2013 program.

Perhaps investors are simply wanting to see more than Alpha and Fission can deliver, after all, there is a physical limit to how fast these companies can drill. I hate to invoke the words of a value investor in something as speculative as mining exploration, but as Ben Graham once said, "In the short term, the market behaves like a voting machine, but in the long term the market acts more like a weighing machine.". So far it looks like Patterson Lake has some weight to it, but only time will tell.

In the meantime, the drills continue to turn, and with results like these investors can take comfort in the fact that the exploration model is holding up better than anyone would have expected at this early stage. To think that the market can "yawn" at a second hole showing 50+ meters of uranium mineralization just 100 meters from surface should be enough to catch the attention of even the most hardened mining investor.

http://seekingalpha.com/article/1265461-patterson-lake-delivers-are-investors-home

VerwijderenOn the smaller-cap side, probably the most interesting situation I see currently is this discovery made at Patterson Lake by Alpha Minerals Inc. (AMW:TSX.V) and Fission Energy Corp. (FIS:TSX.V; FSSIF:OTCQX). They're 50/50 joint venture partners on the project and finding some good mineralization at very shallow depths in the less-explored western Athabasca basin. They are drilling what may be the largest radioactive boulder field in the Athabasca basin, which they found on surface on a shoestring budget.

BeantwoordenVerwijderenWhat they found looks like it's basement-hosted uranium along a long conductor corridor that has a 2–3 kilometer prospective strike length. Most recently they drilled a hole that returned 57½ meters of strong mineralization, with what look to be some very high-grade intervals within it. Fission has some core photos on its website, which I would encourage readers to look at. Anyone in the uranium sector can't help but take notice when you start seeing rock like that. The assays are pending, but there's no question that the visuals look good.

Alpha Minerals and Fission could end up with several deposits along that conductor corridor and they still haven't found the source of those boulders. When they do, it will be uranium directly below glacial gravels, and we haven't seen that yet. This is probably one of the best uranium discovery stories on the planet right now, given the depth, location and the data we've seen so far.

I credit Alpha's management team for putting together the budget they did and staying alive through some very tough times. Their discovery was made on one of the last holes of the 2012 fall drilling program, when Alpha looked like it was on its last legs, so you have to give management a lot of credit for sticking with it. Ben Ainsworth, the CEO, was VP of Exploration at Hathor during that company's discovery and delineation phase so he's got the experience I like to see in junior companies. Michael Gunning recently joined as chairman. He was the CEO of Hathor and took it through the final delineation phase and on through its sale to Rio. These are two top-drawer individuals with a depth of experience not often seen.

Fission adds a lot of value to the junior venture as well, and I think there are a lot of complimentary skill sets between the two companies. Fission Chairman and CEO Dev Randhawa has done a great job of keeping the company going in a very tough market. Fission President, COO and Director Ross McElroy is very well known and well regarded, too. Between the two companies, you really have a great combined team.

TER: Do you have any price projections on Fission and Alpha from here?

MS: It's still early. I did write an article on Seeking Alpha that discussed a hypothetical deposit in the 50 million pound (50 Mlb) range and just doing some back-of-the-envelope math on it using $10/lb, which given the depth I don't think is a stretch. A 50-Mlb deposit should be worth $500M down the road. Alpha's current fully diluted share count is about 25 million shares and with further dilution along the way, it may get to 30–35M shares. You're looking at a $7–8 stock. What gets me really excited is 50 Mlb might be conservative, as there's certainly room to put multiples of that size together.

It's drilling holes that take about two days per hole, per rig, and it has two rigs going. News flow has been pretty consistent. I'd expect news every week or two.

http://www.theenergyreport.com/pub/na/15069

VerwijderenAlpha Minerals Hits 18.9m Total of "Off-Scale" in Hole PLS13-053 at Patterson Lake South

BeantwoordenVerwijderenVANCOUVER, BRITISH COLUMBIA--(Marketwire - March 13, 2013) - Alpha Minerals Inc. ("Alpha" or "the Company") (TSX VENTURE:AMW), and its Joint Venture partner Fission Energy Corp. are pleased to announce the most recent drill results from delineation drilling in the recently discovered R390E zone. (See news release dated March 11, 2013). With 18.9m of off-scale (>9999 cps) mineralization,PLS13-053 represents the widest, largest accumulation of discrete off-scale mineralized intervals in any drill hole on Patterson Lake South ("PLS") property to date.

PLS13-053 Drilling Highlights include:

15m step out west of PLS13-038 extends strike length of R390E zone to 30m

67.0m of basement mineralization in two zones, separated by only 3.5m of barren rock

Upper zone (66.0m - 116.5m) with 17.4m total off-scale radioactivity in several discrete intervals including 8.9m of continuous off-scale (>9999 cps) (95.5m - 104.4m)

Lower zone (120.0m - 136.5m) with 1.5m of off-scale in two discrete (>9999 cps) intervals

PLS13-053 Up-Hole Triple Gamma Log is attached at the end of the news release.

R390E Zone:

Drill hole PLS013-053 was collared as a vertical hole, but deviated slightly to a dip of -89.26° to the SE. The hole was drilled to a depth of 282.5m. The hole is collared 15m grid west of PLS13-038. Two main zones of mineralization were intersected (50.5m and 16.5m width respectively), separated by 3.5m of unmineralized rock. The upper zone (66.0m - 116.5m) is characterized by weak to moderate to strongly mineralized throughout. A total of 17.4m of off-scale radioactivity (>9999 cps) was intersected throughout, with the largest discrete interval measuring 8.9m (95.5m to 104.4m). The lower zone (120.0m to 136.5m), similar to the upper zone, is characterized by weak to moderate to strong mineralization throughout. A total of 1.5m of off-scale radioactivity (>9999 cps) was intersected in 2 discrete intervals. Several additional narrow intervals of weak mineralization were present from 145.0m to 219.5m (see Table 1). A thin cap of Devonian sandstone was encountered from 49.4m to 51.4m, overlying a quartzitic gneiss to a depth of 57.5m. The quartzitic gneiss was underlain by an intensely altered graphitic pelitic gneiss hosting multiple discrete graphitic shear zones. The hole was terminated at a depth of 282.6m in barren unaltered semi-pelitic gneiss. Moderate to strong clay alteration is present from 51.4m to 159.3m, flanked above and below by weak to moderate clay and chlorite alteration.

67 m Ur-erts, waarvan bijna 19 m te veel straling om te kunnen meten (dus ruimschoots boven de 1%).

VerwijderenIedereen met interesse voor Ur-aandelen moet AMW en/of FIS kopen, want HAT zal vrijwel zeker ver overtroffen worden (in alle opzichten).

De recente koersdruk bij AMW komt bijna zeker door verkopen van warrant-aandelen.

Niet beter om eerst de assays af te wachten, gezien het aandeel toch al zo sterk gestegen is en de potentiele downside ook aanwezig is?

VerwijderenAnoniem,

VerwijderenDat ZOU de juiste tactiek KUNNEN zijn, maar of dat klopt weten we pas als het te laat is.

Aangezien er veel zwerfkeien gevonden zijn met zichtbaar Ur tot meer dan 40% en er nog nooit in de wereld zulke dikke lagen Ur-erts met meer dan 1% Ur gevonden zijn, kunnen de boorresultaten zowel mee als tegenvallen.

In technische zin zullen ze vast niet tegenvallen, maar de Grote Vraag is altijd weer wat de De Markt stiekem had verwacht.

http://image.slidesharecdn.com/uexcorporatepresentation-dec312012-130118194811-phpapp02/95/slide-17-1024.jpg?1358560224

Verwijderenhttp://www.stockhouse.com/bullboards/messagedetail.aspx?p=0&m=32330775&l=0&r=0&s=AMW&t=LIST

VerwijderenCANTOR FITZGERALD CANADA – Equity Research

BeantwoordenVerwijderenUranium

Fission Energy Corp. (TSXV: FIS, OTC: FSSIF, GR: 6F5)

Current Price: $0.92, US$0.88

Market Cap: $103M

Rob Chang, MBA (416) 849-5008

Associate: Michael Wichterle, MBA (416) 849-5005

Best hole yet at Patterson Lake South

18.9m of off-scale mineralization within 67m of total mineralization

· Fission Energy and its 50/50 JV partner Alpha Minerals (AMW-TSXV) have announced what is the best drill hole to date on Patterson Lake South located in the western Athabasca Basin.

· Hole PLS13-053 returned 18.9m of off-scale mineralization (>9999 cps) at the recently named R390E zone. It is located 15m to the west of PLS13-038 and resultantly extends the zone to 30m in length. Based on drilling results to date, the mineralization appears to be open to the east, west and north.

·PLS13-053 returned two zones of mineralization:

-Upper Zone (66.0m – 116.5m) contains 17.4m of total off-scale radioactivity in several discrete intervals with the longest being 8.9m of continuous off-scale (95.5m – 104.4m)

- Lower Zone (120.0m – 136.5m) contains 1.5m of off-scale in two discrete intervals

· As a rule of thumb, scintillometer readings of 5000 cps roughly equates to 1% U3O8. The scale is not linear and the relationship past 5000 cps is generally parabolic. The global median U3O8 grade is 0.08%.

The hits continue to come for this project as the east and west step-out holes from PLS13-038 are producing similar to better scintillometer results. The thesis that this may be the next deposit in the Athabasca Basin continues.

Rob Chang

Research Analyst, Metals & Mining

A Note on Valuation

BeantwoordenVerwijderenAs I have mentioned before, valuation of exploration projects is tricky, as any such valuation attempt is dependent on inference and assumptions. Without delving into discussions regarding untested strike length, zone thicknesses, and speculations on grade, perhaps history is the best guide. I apologize to Fission holders for using Alpha as the example here, but given it's "pure play" status, it makes the math easier.

Hathor Exploration's (HAT-TO) Roughrider Zone [sold to Rio Tinto (RIO) for $650mm in 2011] is the most recent market comparable that can be reasonably compared to Patterson Lake. I am not saying that we are there yet by any stretch, but what I can say is that in the early stages of that company's history at Roughrider, it was extremely comparable to Patterson Lake today.

After Hathor received assays from its first hole in March 2008, which graded 5.29% U308 over 11.9 meters, the company had a market cap of $160 million for 90% of it's project, which translates into about $180 million on a 100% basis. Two-and-a-half months later, when all of the data was in from their winter drill program (12 holes with assays were reported in this press release), the market cap was about $210 million, or $230 million on a 100% basis. By September of 2008, part way through the summer drill program, Hathor's market cap was about $320 million, or $350 million on a 100% basis before the financial collapse in 2008. I would point out that uranium was not in favor at the time as a sector. The 2007 price bubble of $140 per pound had popped, and sentiment in the uranium sector was poor.

During these early days, the extent, geometry, and continuity of the Roughrider deposit were unknown. I point this out because this is arguably a very comparable situation to where Alpha and Fission are today at Patterson Lake. Arguably at this stage Patterson Lake offers more running room that Roughrider ever did in its early days, simply due to the scale of the property and length of the mapped conductors. So what does this mean? Well, I would argue that it gives some reasonable goal posts for valuing Patterson Lake today. On the low-end the market cap of Hathor's project was $180 million on initial assays and it was $350 million mid-way through their summer program.

2)

BeantwoordenVerwijderenAssays are not likely that far off for Fission and Alpha based on a standard 4-6 week assay turnaround. Also, consider that Patterson Lake mineralization is anywhere from 1/2 to 1/5 as deep as mineralization that was encountered at Hathor's Roughrider. This makes a huge difference in terms of a potential strip ratio. This means that while 5-10% U308 was enough to keep Hathor investors happy, 1-2% U308 at Patterson would likely do quite nicely. If Patterson delivered anything close to 5% U308 at such shallow depths, I believe the implications in terms of potential economics would be significant.

It is also important for investors to distinguish between the "on-land" Zone 00E and the "lake" Zone 390E. On land (at Zone 00E), the mineralization is not as pervasive, with the thickest off-scale interval totaling 4.35 meters. On the lake (at Zone 390E), the three holes drilled in the zone so far have shown much heavier mineralization based on the gamma logs, with off-scale intervals totaling between 10.5 meters to 18.9 meters. In general, I would expect on-land holes to be lower grade than lake holes, based on the data released to date.

Alpha is trading at C$3.80 as I write this, which means that the project is valued at about $150 million on a 100% basis (Alpha's current share count is about 20 million shares outstanding). At a $180 million project valuation, Alpha would be trading at $4.50/share for its 50% interest. At a $350 million valuation, Alpha would be trading at $8.75/share.

Both of these comparable valuations are based on using the trading history of Hathor as a guide and making some qualitative observations about the projects of the respective companies. I present this historical context as food for thought, given that there are no current comparables in the market.

It's up to investors to decide for themselves whether or not to use history as a guide, but given the shallow depth and low costs of drilling out the Patterson Lake property, I believe Alpha and Fission have a chance to look a lot like Hathor in fast forward if the assays come back with good numbers.

Read more at http://www.stockhouse.com/bullboards/messagedetail.aspx?p=0&m=32325303&l=0&r=0&s=AMW&t=LIST#xYPRZ5yYLfpqw15W.99

http://seekingalpha.com/article/1273521-patterson-lake-project-valuation-using-history-as-a-guide

VerwijderenMooi verhaal:

Verwijderenhttp://ceo.ca/alpha-minerals/

ABR.V is een bedrijf dat naast het desbetreffende gebied van Fission/AMW zit. Wellicht ook interessant om in de gaten te houden

BeantwoordenVerwijderenHendrik,

VerwijderenAlle buren moeten geheel met niks beginnen, de enige die volgens mij snel zou kunnen gaan boren is Nexgen (te koop via Tigris Uranium). Nexgen ligt precies 'op strike' met de vondsten van FIS/AMW.

Ik doe bijna nooit mee met 'areaplays', maar voor Tigris zou ik een uitzondering kunnen maken, omdat bijna niemand dit aandeel kent.

Geen idee wat er aan de hand is, maar AMW en FIS spuiten omhoog: 4,30 en 1,05 gezien.

BeantwoordenVerwijderenMogelijk een lek of hebben grote instutionele beleggers nu pas het aandeel ontdekt. :P

VerwijderenVlak voor de beurssluiting heeft iemand via Credit Suisse een grote hoeveelheid aandelen gekocht, dit zou te maken kunnen hebben met het navolgende bericht.

VerwijderenIk zou niet graag in de schoenen staan van deze persoon, want het is wel erg dom om vlak voor een bericht zoveel aandelen te kopen tegen fors hogere koersen, want dit riekt dan automatisch naar misbruik van voorkennis.

Ik had al een vermoeden dat er een persbericht zou komen. Ik had alleen gerekend op de boorstalen, die trouwens elk moment eraan kunnen komen.

VerwijderenDesalniettemin, een mooi persbericht en het ziet er naar uit dat we weer met een ''world class deposit'' te maken hebben.

Ben benieuwd of het losse pods zijn of dat het misschien allemaal uitmaakt van een groter systeem.

Veel succes allemaal!

G-member,

Verwijderenhet zijn zeker 'pods', maar wel verticale pods met een grootte (hoogte) die we nog niet eerder gezien hebben.

Bovendien ligt er een hele rij van deze pods langs de 'conductor' en ligt hun gebied vol met 'conductors'.

Zie cross-sections op website AMW.

Bedankt voor de info!

VerwijderenIk heb de maps/cross sections enz nog niet goed bekeken. Ik zal het even gaan beter bestuderen.

Alpha Minerals Discovers Third Zone of Uranium Mineralization and "Off-Scale" Radioactivity 780 meters East of Original Discovery at Patterson Lake South, Athabasca Basin

BeantwoordenVerwijderenMarketwirePress Release: MINING EXPLORATION UPDATE – 4 minutes 41 seconds ago

Symbol Price Change

AMW.V 4.15 0.39

VANCOUVER, BRITISH COLUMBIA--(Marketwire - March 18, 2013) - Alpha Minerals Inc. ("Alpha" or "the Company") (TSX VENTURE:AMW), and its Joint Venture partner Fission Energy Corp. are pleased to announce the discovery of a third zone of uranium mineralization and off-scale radioactivity located 780m east of the original discovery on its Patterson Lake South ("PLS") property in the Athabasca Basin, Saskatchewan.

This news release is for results from two diamond drill holes completed 780m east along trend of the R00E zone (initial discovery zone). These holes are approximately 390m east of the recently announced drill hole 38 at R390 Zone, the second zone of mineralization discovered on the property.

Holes PLS13-048 and 055 were both drilled on section L780E. PLS13-055 intersected three radioactive intervals within sheared, graphitic, chloritic, sulfide-bearing metapelitic gneiss, including two discrete narrow intervals of off-scale radioactivity.

Description of Results from the new R780E Zone

The drill target area at section L780E was designed primarily to test a radon in water anomaly with a value of 3.1 pCi/L. The radon anomaly is on trend to the E-NE from the R00E and R390E zones, and is situated at the east end of the PL-3B EM conductor and associated resistivity low corridor that is terminated by an inferred cross cutting structure.

Hole PLS13-048 is vertical, and tests the center of the radon in water anomaly. A 22.0m interval (155.0m - 177.0m) of weak to moderate radioactivity was intersected in a semipelitic gneiss, below a sequence of alternating pelitic and semipelitic gneiss. Radioactivity within this interval reached up to 2800 cps.

Hole PLS13-055 is vertical, and 15m grid south of PLS13-048. Basement rock from 55.0 to 105.5m consists of alternating sequence of semipelitic and pelitic gneiss. From 105.5m to 190.7m, basement rock is dominantly a pelitic gneiss with pronounced intervals of sulfide-bearing, chloritic graphite shear zones. The shear zone is sub- vertical, with fabrics at low angles to drill core. Within this interval there are multiple zones of anomalous radioactivity ranging in widths from 0.5m - 11.0m (see Table 1). Strong radioactivity is recorded in three intervals of sheared graphitic pelitic gneiss with millimeter-scale blebs of pitchblende:

a) 109.0m - 114.0m (5.0m) - weak to strong radioactivity up to 9000 cps

b) 139.5m - 145.0m (5.5m) - weak to strong radioactivity including a 0.1m interval of off-scale (>9999 cps) radioactivity

c) 165.5m - 176.5m (11.0m) - weak to strong radioactivity including a 0.8m interval of off-scale (>9999 cps) radioactivity

Basement rock from 190.7m to 261.2m (EOH) consists of a semipelitic gneiss.

Results at the R780E Zone expand significantly strike extent of uranium mineralization at Patterson Lake along the main target corridor of conductors associated with a resistivity low anomaly. Additional drilling is planned prior to the completion of the current winter program in order to further evaluate this new zone.

http://www.juniorminingnetwork.com/junior-miner-news/news-releases/1027-tsx-venture/amw/9771-alpha-minerals-discovers-third-zone-of-uranium-mineralization-and-quot-off-scale-quot-radioactivity-780-meters-east-of-original-discovery-at-patterson-lake-south-athabasca-basin.html

BeantwoordenVerwijderenBeste allemaal,

BeantwoordenVerwijderenIk lees trouw al jullie berichten, heel praktisch in de mail, het posten is wat omslachtig, vandaar.

Ik ben erg blij met mijn grote post Fis, en het feit dat Precies die berichten kan doorgronden.

Zelf ben ik ook andere uraniumbedrijven aan het bijkopen, Paladin heb ik vrij veel, laatst al wat Denison gekocht, vooruitlopend op de omwisseling van Fis, wat UEX en UR Energy, en vandaag een post Energy Fuels verdubbeld. Ook de ETF URA.

Ik denk dat in de loop van dit jaar we toch eindelijk wat meer beweging kunnen gaan zien, en dan zullen de winsten enorm zijn.

Veel succes allen, Fis kan in elk geval niet meer stuk, stevig vasthouden die spin-off.

Robert

Hallo Robert,

Verwijderenleuk om weer iets van je te horen!

Blijkbaar zit je heel erg dik in de uranium,

heb je al een geigerteller gekocht.....??

Dan kan je meten of je radon-gas in je kruipruimte hebt.

lol

Robert,

Verwijderenin je rijtje mis ik AMW en EUU, deze laatste is nog steeds verreweg het goedkoopste Ur-aandeel, terwijl Paladin volgens mij een van de duurste Ur-aandelen is.

Dank je, Precies. EUU was ik nog vergeten, waarschijnlijk weggedrongen vanwege een behoorlijk verlies,net zoals Dyl. Alpha heb ik niet vanwege het feit dat Fission meer dan de helft uitmaakt van de totale uraniumportefeuille. Ik las laatst nog op het stockhouseforum over Purepoint, die hebben we vroeger ook gehad, heeft net een geslaagde claimemissie gedaan, ze hebben dus weer geld,en ze hebben 3 joint-ventures met majors, op dit koersje van 6,5 cent lijkt me dat nog wel een aardige risk-rewardplay. Dus daar heb ik er ook 200.000 van.In april schijnen er weer boringsresultaten te komen.

BeantwoordenVerwijderenIn zijn algemeenheid ben ik terughoudend geworden om teveel te beleggen in exploratiebedrijven met telkens geldnood. Daarom is bijv. Energy Fuels volgens mij een goede koop, productie nu al 1 miljoen pound, en 34 miljoen in kas, bij een beurswaarde van 100 miljoen.

Je moet ook eens kijken naar EXK, koers ruim 6, winst p.a. 45 cent, groeit jaarlijks fors, waarschijnlijk 10 x de winst dit jaar.De GDX gemiddeld staat ook 10 x de winst, is zelden voorgekomen.Primero ook zo´n groeier, lage kw.

Succes,

Robert

Hallo Robert,

Verwijderenbedankt voor je recente bijdragen!

EXK is ook een favoriet van Jack Hoogland en deze ga ik zeker kopen.

Jouw ideeën en favoriete aandelen zijn voor mij en de lezers zeer interessant en ik hoop dus dat je nog meer bijdragen wilt plaatsen.

BeantwoordenVerwijderenAlpha Minerals JV R00E Zone, Grows with More "Off-Scale" Radioactivity with Grid Drilling at Patterson Lake South, Athabasca Basin

AMW:CA AMW

3/19/2013 7:30:11 AM

Alpha Minerals JV R00E Zone, Grows with More "Off-Scale" Radioactivity with Grid Drilling at Patterson Lake South, Athabasca Basin

VANCOUVER, BRITISH COLUMBIA--(Marketwire - March 19, 2013) - Alpha Minerals Inc. ("Alpha" or "the Company") (TSX VENTURE:AMW), and its Joint Venture partner Fission Energy Corp. are pleased to announce results from 10 additional step-out drill targets in the R00E zone at the Patterson Lake South (PLS) property. All 10 holes intersected anomalous radioactivity, with 8 holes intersecting significant mineralization, including 6 holes intersecting variable amounts of off-scale radioactivity.

The Operator reports that the R00E zone has now been traced for over 80m of mineralized strike length at shallow depth from PLS13-049 (L060W) to the west to PLS13-052 (L015E) to the east, and over 50m wide (L025W). The zone remains open along strike and width.

Drilling Highlights include:

PLS13-052 (L015E) intersected 31.5m of weak to strong mineralization with 5.95m of off-scale (>9999 cps) radioactivity: mineralization starting at 62m

PLS13-043 (L040W) intersected 26.5m of weak to strong mineralization with 4.63m of off-scale (>9999 cps) radioactivity: mineralization starting at 63m

PLS13-041 (L040W) intersected 19.0m of weak to strong mineralization with 4.15m of off-scale (>9999 cps) radioactivity: mineralization starting at 63m

Read more at http://www.stockhouse.com/bullboards/messagedetail.aspx?p=0&m=32344907&l=0&r=0&s=AMW&t=LIST#Ar73XefuVLIE4ofE.99

HIGH GRADE BOULDER FIELD HIGHLIGHTS:

BeantwoordenVerwijderenTo date (January 2nd, 2013), a total of 156 boulders and 32 soil samples have submitted for assay with the boulders ranging in size from gravel material to mineralized cobbles and boulders up to 45 X 35 X 30 cm.

Of the 188 geochem samples there are:

63 or 33.5% of the samples assayed: < 1% U3O8

50 or 26.6% of the samples assayed: 1%-10% U3O8

75 or 39.9% of the samples assayed: > 10% U3O8

Highest grade assaying at 40.0% U3O8

Alpha Minerals Reports 34m of 4.92% U3O8, Including 12.5m at 12.38% U3O8 in Drill Hole PLS13-038, Patterson Lake South JV

BeantwoordenVerwijderenMarketwirePress Release: MINING EXPLORATION UPDATE – 5 hours ago

Symbol Price Change

AMW.V 4.39 -0.06

VANCOUVER, BRITISH COLUMBIA--(Marketwire - March 24, 2013) - Alpha Minerals Inc. ("Alpha" or "the Company") (TSX VENTURE:AMW) (E2GA.F), and its Joint Venture partner Fission Energy Corp. are pleased to report initial assay results from the ongoing winter drill program on its Patterson Lake South ("PLS") Property. These assay results are from drill hole PLS13-038, the first hole drilled on the R390E zone.

PLS13-038 is part of the R390E zone located 385m drill grid east of the Patterson Lake discovery hole PLS12-022 at the R000E zone (see news release February 9, 2013). Composited drill hole mineralized intersections for PLS13-038 returned two broad zones of uranium mineralization:

UPPER URANIUM ZONE = 34m (87.0m - 121.0m):

34.0m @ 4.92% U3O8; Grade times Thickness Product = 167.3

Includes 12.5m @ 12.38% U3O8

Including 0.5m @ 35.10% U3O8

LOWER URANIUM ZONE = 17.5m (126.5m - 144.0m):

17.5m @ 0.96% U3O8; Grade times Thickness Product = 16.8

Includes 5.5m @ 2.07% U3O8

All intersections reported here are core length measurements and not true width measurements - actual true widths may be smaller than core lengths.

Composited U3O8 mineralized intervals are summarized in Table 1 below Samples from the drill core are split in half on site. Most samples are standardized at 0.5m down-hole intervals. One-half of the split sample is sent to the laboratory for analysis and the other half remains on site for reference. The results show that the uranium is concentrated primarily two zones beginning at relatively shallow depth in basement graphitic metapelitic lithology and with continuous substantial widths. Uranium concentration is relatively consistent throughout the mineralized sections. In addition, there are several narrower intervals of low grade uranium mineralization between 165.0m - 181.0m. Not all assay results have been received for PLS13-038- samples yet to be received are from non-radioactive intervals.

Mooie persbericht en nog wel op een zondagavond.

BeantwoordenVerwijderenGelukkig geen echte sell off, maar verstandige kopers die inzien dat dit toch echt weer een real deal is.

Ben benieuwend hoe hoog het aandeel gaat pieken.

Veel succes allemaal!

Fission Energy Corp.: 4 Step-Outs Hit Off-Scale at PLS. Strike of R390E Doubles to 60m

BeantwoordenVerwijderenfission-energy-corp-4-step-outs-hit-off-scale-at-pls-strike-of-r390e-doubles-to-60m

KELOWNA, BRITISH COLUMBIA--(Marketwired - April 3, 2013) - FISSION ENERGY CORP. (TSX VENTURE:FIS)(OTCQX:FSSIF) ("Fission" or "the Company"), and its Joint Venture partner Alpha Minerals Inc. are pleased to announce results from 4 additional step-out drill targets in the R390E zone at the Patterson Lake South (PLS) property, expanding the strike length to 60m. This zone is one of three discovered by the JV in the current drill program.

All four holes intersected off-scale radioactivity within broader zones of lower but continuous radioactivity and holes PLS13-061 and PLS13-066 have extended the high-grade mineralized section of the zone 15m to the west and 15m to the east respectively. R390E has now been delineated with 9 drill holes and is open in all directions. Extensive follow-up drilling is planned for this zone for the upcoming 2013 summer program.

Ross McElroy, President, COO, and Chief Geologist for Fission, commented:

"As with our other two discovery zones at PLS, this zone continues to see considerable off scale radioactivity as it expands in size. It remains open along strike and width and these results are confirmation of the zone's potential."

An ongoing field program including 9,000m to 10,000m of drilling is in progress and will continue to take advantage of the winter ice expected to last into early April.

Drilling Highlights include:

Holes PLS13-061 and 066 have doubled the strike length of the high grade core as intersected in holes PLS13-038, 051 and 053 to 60m.

PLS13-066 (L420E) intersected 64.0m of weak to strong mineralization (81.5m - 145.5m) with a total of 5.57m of off-scale (>9999 cps) radioactivity

PLS13-061 (L360E) intersected four mineralized radioactive intervals (76.5m - 140.0m) ranging in strength from weak to strongly radioactive and in width from 1.0m to 30.5m, including a 30.5m of interval ranging from weak to strong mineralization (109.5m - 140.0m) with a total 4.13m of off-scale (>9999 cps) radioactivity

R390E Zone:

The R390E zone refers to the zone of mineralization located ~390m on-strike to the east of R00E, and first encountered in PLS13-038 (see news release Feb 19, 2013). As is the case with the R00E zone, R390E mineralization is spatially located proximal to the north of the PL-3B basement EM conductor and situated within a well-defined resistivity low corridor. Drillhole interpretation thus far defines the area of mineralization to be associated with a steeply south dipping pelitic (+/- graphitic) lithology sandwiched between a semipelitic gneiss to the north and a quartz-feldspar gneiss to the south, where the mineralization is focused primarily near the contact between the pelitic gneiss and quartz-feldspar gneiss.

Line 420E

Hole PLS13-066 was a vertical hole collared 15m grid east of hole PLS13-051. A 2.1m wide interval of Devonian sandstone (49.7m - 51.8m) overlies the basement quartzitic gneiss hanging wall of the pelitic gneiss corridor. Scintillometer results shows a 64.0m wide continuous zone of weak to strongly radioactive mineralization from 81.5m - 145.5m. The mineralization occurs predominantly within strong to intensely clay altered pelitic gneiss with the top of the mineralized interval developing near the contact of an overlying quartzitic gneiss. Several discrete intervals of off-scale (>9999 cps) radioactivity, ranging in widths of 0.1m - 1.26m were recorded throughout for a total of 5.57m.

As usual weer een flinke sell off om vrolijk van te worden. LOL

BeantwoordenVerwijderenVoor de lieden die er nog niet inzitten of nog een positie willen uitbreiden.

Grijp je kans!

Succes aan allen!

Analisten research rapport van Cantor Fitzgerald

BeantwoordenVerwijderenhttp://www.cantorcanada.com/pdfFiles/20130403AMW.pdf

Patterson Lake: Is The Past The Key To The Present?

BeantwoordenVerwijderenApr 10 2013, 18:31 | about: FSSIF.PK, ESOFD.PK

Disclosure: I am long ESOFD.PK. (More...)

Patterson Lake Update

In separate press releases dated April 1st and April 3rd, 50/50 JV partners Fission Energy (FSSIF.PK) and Alpha Minerals (ESOFD.PK) reported additional drill data from their ongoing drill program at the Patterson Lake uranium project. The drill holes reported included a 15-meter step-out on the 780E Zone that intersected 70 meters of mineralization and four holes from the 390E Zone that doubled the known mineralized strike length of that zone to 60 meters. In aggregate, Patterson Lake has now been shown to have proven mineralization over a total strike length of 155 meters in three separate zones (00E, 390E, and 780E) spanning 800 meters of strike. The intervals between these zones remain largely untested and are within a 2 kilometer-long prospective corridor. Mineralization remains open to expansion in all directions.